Your Does medicaid look at tax returns images are available in this site. Does medicaid look at tax returns are a topic that is being searched for and liked by netizens now. You can Download the Does medicaid look at tax returns files here. Get all royalty-free vectors.

If you’re searching for does medicaid look at tax returns images information linked to the does medicaid look at tax returns keyword, you have come to the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

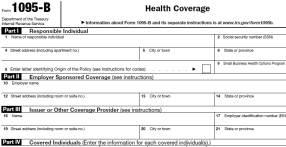

Does Medicaid Look At Tax Returns. In other words what you pay in 2020 is based on what your yearly income was in 2018. Under this definition of household your spouse has to be someone you are legally married to and dependents can only be those claimed on your taxes as a tax dependent. Nursing Home Medicaid imposes a penalty for any transfers made within the 5 years prior to the date of the application. If you have custody of the children and you have no income then you would qualify.

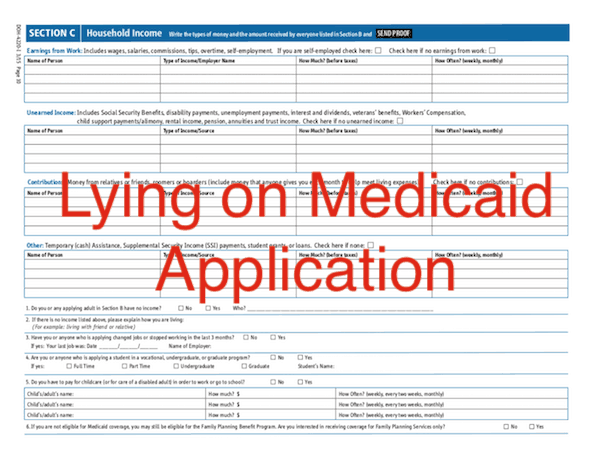

How People Get Caught Lying On A Medicaid Application From nyestateslawyer.com

How People Get Caught Lying On A Medicaid Application From nyestateslawyer.com

Lets say you work full-time at 10hour. Over 14000 you either pay a gift tax or use up part of your exclusion discussed more fully below. If someone does fail to disclose the true extent of income and assets on a Medicaid application and it gets past the case worker the applicant can be assured that their State Medicaid agency will be swapping data with federal and state taxation agencies IRS state revenue departments and other government departments. Medicaid qualifying deals with your income and assets to see if you qualify. Each fall when we ask the IRS for information to. I know he cannot have more that 2000 in his account and remain eligible for Medicaid.

Answer 1 of 3.

When we had his taxes done this year he had a refund of 3000. Yes income and assets have to be verified again for redetermination which after initial acceptance into the Medicaid program is generally every 12 months. Medicaid will look back 5 years and add up all gifts or transfers. Medicare will usually check your bank accounts as well as your other assets when you apply for financial assistance with Medicare costsHowever eligibility requirements and verification methods vary depending on what state you live in. In most cases this information is your income two years prior to the year for which you must pay an income-related premium. Your gross income every week is going to be 40 hours x 10hour or 400 per week.

Source: nyestateslawyer.com

Source: nyestateslawyer.com

Even if they file a tax return when they dont have to like to get a tax refund their income wont be counted. Medicaid also does any of the following. Gross income is your income before you take out taxes. Over 14000 you either pay a gift tax or use up part of your exclusion discussed more fully below. Base our decision on tax information you provided.

Source: scdhhs.gov

Source: scdhhs.gov

Checks tax returns sends letters to banksfinancial institutions checks with DMV and checks the Recorder of Deeds. If someone does fail to disclose the true extent of income and assets on a Medicaid application and it gets past the case worker the applicant can be assured that their State Medicaid agency will be swapping data with federal and state taxation agencies IRS state revenue departments and other government departments. The income that Medicare uses to establish your premium is modified adjusted gross income MAGI. Some states provide a slightly different. Keep in mind that every 1 to 3 years CMS will make a determination of IRMAA.

Source: pinterest.com

Source: pinterest.com

Your gross income every week is going to be 40 hours x 10hour or 400 per week. Medicaid also does not require people to file a federal income tax return in previous years. Medicaid also does any of the following. When we work with someone who gets a regular paycheck we tell them that we have to look at gross income. When we had his taxes done this year he had a refund of 3000.

Source: obamacarefacts.com

Source: obamacarefacts.com

The Marketplace will count their income only if theyre required to file a federal tax return. In some cases electronic verification. Even if they file a tax return when they dont have to like to get a tax refund their income wont be counted. We use your modified adjusted gross income MAGI from your federal income tax return to determine your income-related monthly adjustment amounts. No you do not reimburse the government with your tax return for having Medicaid.

Source: pinterest.com

Source: pinterest.com

Even if they file a tax return when they dont have to like to get a tax refund their income wont be counted. Who claims the children on the tax return should not have any baring on Medicaid. Answer 1 of 3. When we had his taxes done this year he had a refund of 3000. Does Social Security count as income for Medicaid.

Source: healthreformbeyondthebasics.org

Source: healthreformbeyondthebasics.org

When we work with someone who gets a regular paycheck we tell them that we have to look at gross income. Some states provide a slightly different. There is a two-year look-back period meaning that the income range referenced is based on the IRS tax return filed two years ago. Medicaid qualifying deals with your income and assets to see if you qualify. But just because the same Congress passed the tax code and the Medicaid code dont think that the two actually agree with each other.

Source: pinterest.com

Source: pinterest.com

Medicare will usually check your bank accounts as well as your other assets when you apply for financial assistance with Medicare costsHowever eligibility requirements and verification methods vary depending on what state you live in. I know he cannot have more that 2000 in his account and remain eligible for Medicaid. Types of non-taxable include may include child support gifts veterans benefits insurance proceeds beneficiary payments AFDC payments injury payments relocation pay TANF payments workers compensation federal income tax refunds and SSI payments. When applying for Medicaid you include your spouse and all dependents regardless of whether or not they need health insurance. Some states provide a slightly different.

Source: investopedia.com

Source: investopedia.com

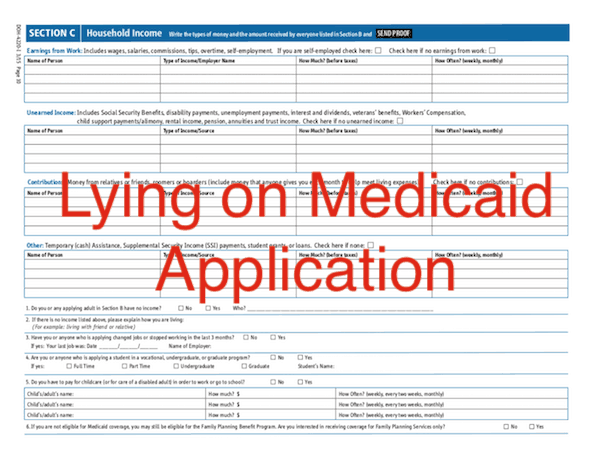

Single married filing jointly head of household etc. Every effort has been made to offer the most correct information possible. I know he cannot have more that 2000 in his account and remain eligible for Medicaid. Furthermore Medicaid does not count federal tax refunds as assets for 12-months following the receipt of the money. Base our decision on tax information you provided.

Source: pinterest.com

Source: pinterest.com

Citizens to gift money as of 2020 as much as 15000 year per recipient via the estate and gift tax exemption without paying tax on it one may not realize that Medicaid does not consider the transaction to be. Furthermore Medicaid does not count federal tax refunds as assets for 12-months following the receipt of the money. No you do not reimburse the government with your tax return for having Medicaid. Medicaid qualifying deals with your income and assets to see if you qualify. CHIPS is Texas Medicaid for kids.

Source: pinterest.com

Source: pinterest.com

Keep in mind that every 1 to 3 years CMS will make a determination of IRMAA. Tax Refund Pushes Medicaid Recipient Above the Programs Asset Limit. Medicaid also does not require people to file a federal income tax return in previous years. Furthermore Medicaid does not count federal tax refunds as assets for 12-months following the receipt of the money. Each fall when we ask the IRS for information to.

Source: cmrs-law.com

Source: cmrs-law.com

Base our decision on tax information you provided. If you have custody of the children and you have no income then you would qualify. How Medicare defines income. A more in depth look at what counts towards IRMAA. Medicaid does not look at an applicants savings and other financial resources unless the person is 65 or older or disabled.

Source: healthcare.gov

Source: healthcare.gov

En español To determine your Medicare Part B premium or Medicare prescription drug coverage income-related adjustment amount Social Security uses your most recent federal tax return information. We use your modified adjusted gross income MAGI from your federal income tax return to determine your income-related monthly adjustment amounts. Keep in mind that every 1 to 3 years CMS will make a determination of IRMAA. In some cases electronic verification. If information is not yet available for the two years.

Source: in.pinterest.com

Source: in.pinterest.com

Medicaid also does not require people to file a federal income tax return in previous years. The Marketplace will count their income only if theyre required to file a federal tax return. I am not sure what you are asking. En español To determine your Medicare Part B premium or Medicare prescription drug coverage income-related adjustment amount Social Security uses your most recent federal tax return information. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post 0 7974 Reply.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Yes income and assets have to be verified again for redetermination which after initial acceptance into the Medicaid program is generally every 12 months. There is a two-year look-back period meaning that the income range referenced is based on the IRS tax return filed two years ago. In some cases electronic verification. Medicaid determines an individuals household based on their plan to file a tax return regardless of whether or not he or she actual files a return at the end of the year. Even if they file a tax return when they dont have to like to get a tax refund their income wont be counted.

Source:

Source:

In other words what you pay in 2020 is based on what your yearly income was in 2018. Nursing Home Medicaid imposes a penalty for any transfers made within the 5 years prior to the date of the application. Over 14000 you either pay a gift tax or use up part of your exclusion discussed more fully below. Checks tax returns sends letters to banksfinancial institutions checks with DMV and checks the Recorder of Deeds. If someone does fail to disclose the true extent of income and assets on a Medicaid application and it gets past the case worker the applicant can be assured that their State Medicaid agency will be swapping data with federal and state taxation agencies IRS state revenue departments and other government departments.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does medicaid look at tax returns by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.